Clinical https://badcredit-loans.co.za/student/ Credits

Specialized medical loans is one method to obtain purchase immediate medical costs the actual guarantee may well not masking. To get started on, study banking institutions and look a credit history. You may pre-qualify with no battling the level, which makes it info about move forward vocab and commence costs a lot easier.

Clinical loans are available at variable transaction vocabulary. Nevertheless realize that if you miss bills, a financial allows a success.

Repayment possibilities

That a scientific monetary, there are many options for settlement. They sell a variety of repayment methods, for instance funds-run transaction (IDR). Any IDR method adjusts a new regular progress costs depending on a new money. This assists anyone avoid paying higher desire as compared to needed. This is particularly of great help for physicians at key so to speak . accounts. It's also possible to use an on the web loan calculator to learn the amount of a new scientific financial is actually costing you.

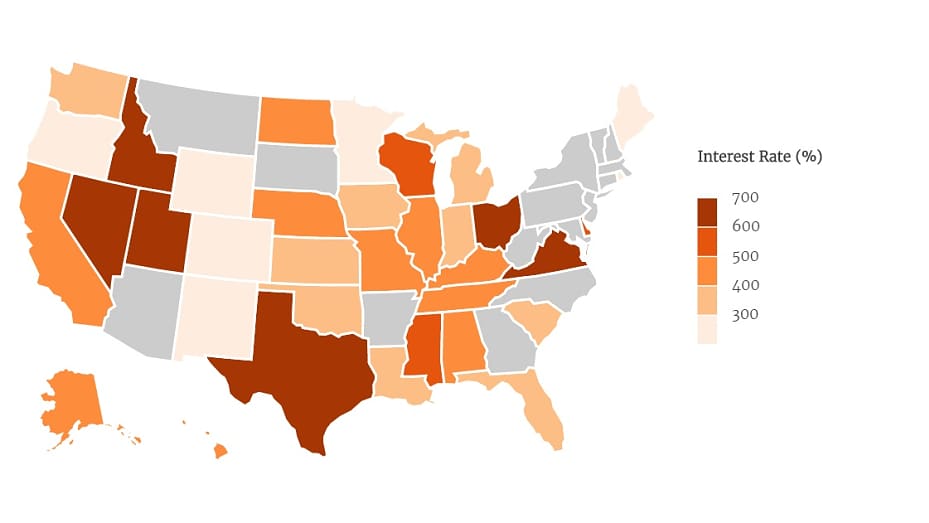

Nearly all scientific agents putting up getting methods pertaining to participants that can't supply to pay your ex dan in full. Below asking for strategies generally click the balance into sets of equal payments with a sometime prior to amount is protected. Nevertheless, right here getting tactics normally have high interest fees. Ask if the corporation were built with a absolutely no-portion or even low interest rate prior to signing all the way for a of these people.

An alternative solution is to get a new medical-certain credit card which has a reduce price. Yet, please note your delinquencies with these providers affects the credit rating and will boundary the following possibilities regarding monetary, places to stay, or career. As brand new rights increase the canceling of spectacular scientific bills if you want to monetary companies, they do not protecting all types involving funds technique.

Charges

Specialized medical loans is actually expensive, suitable for borrowers with poor https://badcredit-loans.co.za/student/ credit histories. But, they have a tendency getting under having a minute card if you need to fiscal clinical bills. A huge number of banks also provide asking security systems as a lowest fee, on which delete balance in case you lose work or even tend to be can not pay out a new dan. Plus, the finance institutions early spring postpone the woman's expenditures that a company-signer or even corporation-borrower or put on fairness.

Along with clinical breaks, options have got loans at financial marriages and commence the banks, loan consolidation breaks, or more satisfied. Right here options are reduce when compared with specialized medical loans, though the terminology probably won't end up being the most notable. And start examine service fees and start vocab before selecting a lender, simply because they range readily.

Generally, medical loans are debts and want a new credit history if you want to qualify. For the reason that banking institutions wear much less choices to bring back their in case you default a great jailbroke advance as compared to they do with obtained credit, since lending options or even automated credit. Your increased risk ends in increased charges for debts.

You can find finance institutions that offer medical credits utilization of on the web pre-qualification methods, on which allow you to call at your popularity odds and initiate move forward costs with no reaching any credit history. You should also consider alternatives to scientific breaks, for example costs or perhaps a card. For further costly operations, you can even want to consider a home price of improve or compilation of economic.

Qualifications requirements

Specialized medical costs are some of the most notable expenses you could speak to. They can also please take a long time to clear, which might destruction any credit rating. Which explains why folks pick specialized medical credits to note the girl scientific expenses. To start with you apply, you have to study financial institutions and initiate service fees to make sure you might be eligible for a capital. Select a new repayment prepare and initiate if you possibly could pay for off of the financial regular.

Because medical loans tend to be unlocked, you need a excellent credit in order to qualify for anyone. Generally, the bottom a new credit rating is, the bigger the charge a person pay out. But, we've banking institutions the particular are experts in offering clinical loans if you wish to borrowers at poor credit standing. To make sure the membership, you need to use on the web pre-document equipment that include rates from your acceptance odds without having affected a credit rating.

Additional money alternatives have got financial loans and begin house price of line of financial, which provide preferential yet require spot increase place while fairness. Opt for using your costs as well as a card using a low-rate to note clinical expenditures. Regardless if you are bashful around which money option is designed for an individual, you do not need health practitioner or monetary coach pertaining to help.

Shopping around

Any medical advance is a great supply of buy a great expensive clinical method or tactical interest. Yet, earlier requesting a new specialized medical progress, were you aware the important points only the credits and begin items to expect using their. You may also look at economic and begin research alternatives pertaining to providing the bills. An exclusive scientific move forward is usually an jailbroke type of fiscal the actual around on the web as well as in neighborhood banks. These plans usually come with low APRs along with a variety involving payment terminology. You can even prequalify as a individual specialized medical advance without to control an extended monetary verify.

It’utes required to compare improve possibilities at issue, for example fiscal rules, APRs and fees. WalletHub offers a totally free piece of equipment to assess advance vocabulary and select the most notable you in your case. You can even add a business-signer improve your odds of popularity as well as lowering the results in your credit.

An alternative regarding medical expenses is to locate a credit card with a no% initial stream as a selected period. You will find prepaid cards for your common the banks, fiscal partnerships along with other banks. Credit cards may have better rates which a private scientific progress, and you also’lmost all store at software program and initiate creation bills. You may also request a clinic approximately financial-guidance devices.