How to Open an Online Account for Forex Trading A Comprehensive Guide 1750266235

How to Open an Online Account for Forex Trading: A Comprehensive Guide

For those looking to delve into the world of Forex trading, one of the first steps is to open an online account. The Forex market, known for its liquidity and potential for profit, can provide traders with numerous opportunities. However, navigating the registration process might seem daunting. This guide will walk you through the crucial steps to set up your Forex account smoothly and efficiently. Don't forget to check out open online account for forex trading Top Mobile Trading Apps to enhance your trading experience.

Understanding Forex Trading

Forex, or foreign exchange, is the largest financial market in the world. It involves trading currencies against one another, with participants ranging from large institutional investors to retail traders. The market operates 24 hours a day, five days a week, allowing for continuous trading. Understanding the basics of Forex trading is essential before opening an account.

Choosing a Reliable Forex Broker

The first step in opening an online Forex account is selecting a reputable broker. Not all brokers are created equal, and it’s crucial to choose one that suits your trading style and financial goals. Consider the following factors when evaluating brokers:

- Regulation: Ensure that the broker is regulated by a reputable authority, such as the FCA (UK) or ASIC (Australia).

- Trading Platforms: The broker should offer a user-friendly trading platform, such as MetaTrader 4 or 5.

- Spreads and Commissions: Compare the cost of trading, including spreads, commissions, and overnight fees.

- Customer Support: Good customer support is essential; ensure that you can reach them easily if you encounter issues.

- Account Types: Look for brokers that offer various account types to suit different trading strategies.

Gathering Required Documentation

Before you can open an online Forex account, you’ll need to gather certain documents for verification purposes. This process helps ensure that the broker complies with regulations and is not facilitating fraud or money laundering. Typically, you’ll need:

- Proof of Identity: A government-issued ID, such as a passport or driver’s license, to confirm your identity.

- Proof of Address: A recent utility bill or bank statement displaying your name and address.

- Financial Information: Some brokers may request details about your financial status and trading experience.

Steps to Open Your Online Forex Account

Now that you have chosen your broker and gathered the necessary documents, you can proceed with opening your account. Here’s a step-by-step guide:

1. Registration

Visit the broker’s website and find the registration or “Open Account” section. Fill in the required details, including your name, email, phone number, and desired password.

2. Account Verification

After registration, you’ll need to verify your identity and address by uploading the documents you gathered earlier. Most brokers will review your submissions within a few hours to a few days.

3. Choosing an Account Type

Select the type of account you wish to open based on your trading preferences. Some brokers offer demo accounts for practice, while others might have different tiers of live accounts with varying spreads and leverage options.

4. Funding Your Account

Once your account is verified, you’ll need to deposit funds to start trading. Brokers usually offer various funding methods, including bank transfers, credit/debit cards, and e-wallets. Be aware of any deposit fees and processing times.

5. Downloading Trading Software

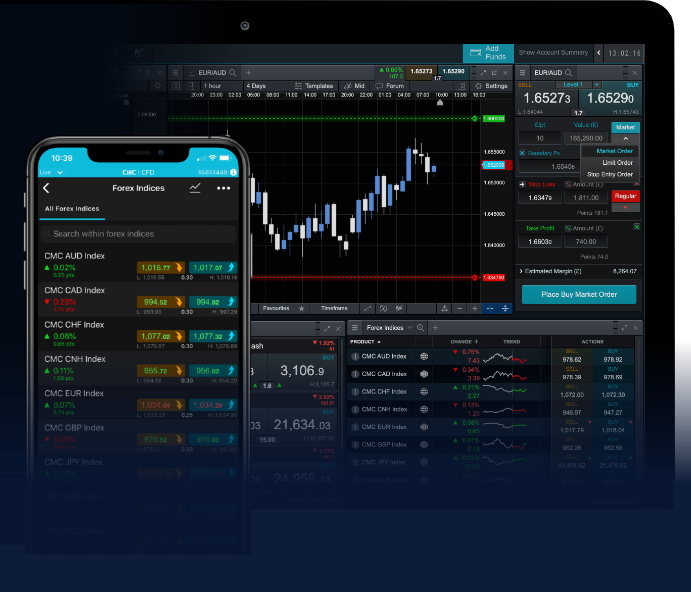

Most brokers offer a desktop and mobile trading platform. Download the trading software and log in using your credentials. Familiarize yourself with the interface, tools, and features available to enhance your trading experience.

Understanding Leverage and Margin

One of the unique features of Forex trading is the use of leverage. Leverage allows traders to control larger positions with a smaller amount of capital. For instance, with 100:1 leverage, you can control $100,000 in currency with just $1,000. However, while leverage can amplify profits, it also increases the risk of significant losses. It is crucial to understand how margin works and to use leverage responsibly.

Effective Risk Management Strategies

Once you’ve opened your account and funded it, it’s essential to implement effective risk management strategies. Here are some key practices:

- Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade.

- Determine Position Sizes: Calculate position sizes based on your trading capital and risk tolerance.

- Avoid Over-leveraging: Use lower leverage to safeguard your capital and minimize risk.

- Diversify Your Trades: Avoid putting all your capital into one trade or single currency pair.

Common Pitfalls to Avoid

As you embark on your Forex trading journey, it’s essential to be aware of common pitfalls that can lead to costly mistakes:

- Lack of Education: Failing to educate yourself about Forex trading can lead to poor decision-making.

- Chasing Losses: Avoid the temptation to recover losses quickly; instead, stick to your trading plan.

- Ignoring Economic News: Economic indicators can significantly impact currency prices; stay informed.

- Emotional Trading: Make decisions based on analysis rather than emotions like fear or greed.

Conclusion

Opening an online account for Forex trading is a straightforward process. By understanding the requirements and steps involved, you can set yourself up for a rewarding trading experience. Choose a reputable broker, maintain effective risk management practices, and continually educate yourself about the Forex market to increase your chances of success. Happy trading!