Journal Entry Examples

After carrying out a business transaction, it is recorded in a book known as the general journal. The general journal is usually used in the first phase of accounting. It has all original transactions recorded in it, in chronological order. This is why it is also known as the book of original entry, chronological book, or daybook. In this article, we will discuss what a general journal is and show some general journal entries examples. Then, enter the date, the accounts, and the amounts in the general journal.

Journal entries: More examples

These include helping to track sales, purchases, inventory, expenses and more. A general journal is just one of the several types of books that can be used to store information. They can be used to show balance sheets and cash flow statements. In addition, they may also be used to show transactions that have been recorded in a general journal or some other type of specialized book of accounts. With the advent of technology, record keeping has been easy, with all the information being stored in a single repository with no specialty journals in use. However, these general journal accounting were more visible in the manual record-keeping days.

Why You Can Trust Finance Strategists

Furthermore as the business maintains control accounts in the general ledger, this entry is not part of the double entry posting which is dealt with by step 3 below. These journal entries are then used to form a general ledger, and the information is transferred into respective accounts of the general ledger. The ledgers are then used to make trial balances and, finally, the financial statements. However, these journals were more visible in the manual record-keeping days. The general journal is simply the book of original entries in which bookkeepers and accountants record raw business transactions in chronological order as they occur.

General Journal Used to Update the Subsidiary Ledgers

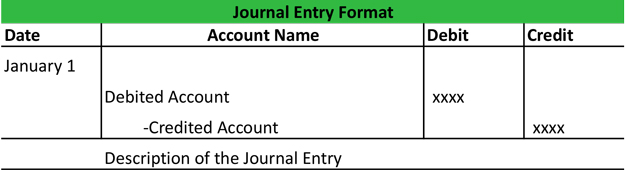

An accounting ledger, on the other hand, is a listing of all accounts in the accounting system along with their balances. Most journals are formatted the same way with columns for the transaction dates, account names, debit and credit amounts, as well as a brief description of the transaction. Manual journal entries were used before modern, computerized accounting systems were invented. The entries above would be manually written in a journal throughout the year as business transactions occurred. These entries would then be totaled at the end of the period and transferred to the ledger.

Example of a General Journal Accounting Entry

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Some transactions do not involve sales, purchases, cash receipts, or cash payments, or are complex to fit conveniently into the general journal.

How Do You Write a General Journal Entry?

- These entries typically include the date, accounts affected, and amounts.

- The first book in which transactions are recorded is called the general journal.

- If they do not equal the same number, you know that something has gone wrong.

- Now that these transactions are recorded in their journals, they must be posted to the T-accounts or ledger accounts in the next step of the accounting cycle.

It is also known as var or als account which means always credit account because it always reduces when there are transactions relating to that accounts. Debit accounts are those account which increases when there are transactions. It is also known as var or als account which means always debit account, because it always increases when there are transactions relating to that accounts.

There are four journals specifically, which record transactions of a similar nature. Their name suggests the kind of transactions that we record in them. These journals are Sales journal, Cash receipts journal, Purchases journal and Cash disbursements journal. The general journal actually serves as a catchall for journal entries that don’t belong in other journals such as adjusting, closing and reversing entries. You can also use special journals for your other high-volume transactions that could not be recorded in the previously mentioned special journals. For example, you may keep a special journal for sales returns if your company encounters frequent product returns from customers.

As Blur Guitar, Inc. buys inventory and makes sales throughout the year, it records all of the transactions as journal entries in the general journal. At the end of the year or the end of a reporting period, these transactions are taken from the general journal and posted to individual ledgers. After transactions are recorded in the general journal, they are typically posted to the ledger accounts, which sort transactions by account. This process helps in preparing the trial balance, income statement, and balance sheet. The general journal is an integral part of the accounting cycle and helps ensure that financial statements are accurate and complete.

Sometimes, an accountant or bookkeeper might decide not to records the journal entries of certain kinds of financial transactions in the general journal. But the record that kind of financial transaction in their own journal. The records mm millions definition, examples, what mm means in the general ledger may contain information about cash receipts and payments. They can even contain investments made on behalf of the business, debts owed to or by the company, liabilities incurred and passive income received.

The general/subsidiary ledger reference refers to the relevant account numbers in those ledgers. In certain instances (see below) an entry may need posting in both the subsidiary ledger and the general ledger and therefore a reference needs to included for both ledgers. The information recorded in the journal is used to make postings to the relevant accounts in the general ledger.